FluidFi’s Unique Offering — Why Would You Ever Want to Use an Exchange Again?

Disclaimer: I am working as a part-time advisor for FluidFi SA and am an investor in $FLUID. This statement is intended to disclose any conflict of interest and should not be misconstrued as a recommendation to purchase any token or participate in any farms. None of the information contained within this article constitutes, or should be relied on as financial or investment advice or a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale or any other investment-related activity with respect to any cryptocurrencies, the $FLUID token or any other transaction.

Today, I want to elaborate on why I think FluidFi’s approach to merging a better banking model with the best of decentralised finance is unique and why it is superior compared to many other models in the market.

The Race for the Mass Market

2021 has been an excellent year for crypto in general. The total cryptocurrency market capitalisation doubled from $1 trillion in early 2021 to $2.3 trillion — and for a brief time even touched $3 trillion in November last year. But not only have prices for digital assets increased dramatically, also the general awareness of the digital asset and blockchain space has seen new heights, including new promising use cases based on decentralised finance (DeFi) and NFTs (non-fungible tokens).

This positive trend has led to more and more people wanting to invest in cryptocurrencies, leading to record user numbers for well-known crypto exchanges like Binance or Coinbase. But also “traditional” FinTech companies like PayPal and others started to embrace crypto and now offer to buy and hold various digital assets within their apps.

We see now centralised and decentralised apps for almost every financial use case within the crypto ecosystem, from trading to lending to investing in derivatives and many more. But what is still missing at this point is a smooth integration of crypto into everyday people’s daily (financial) lives.

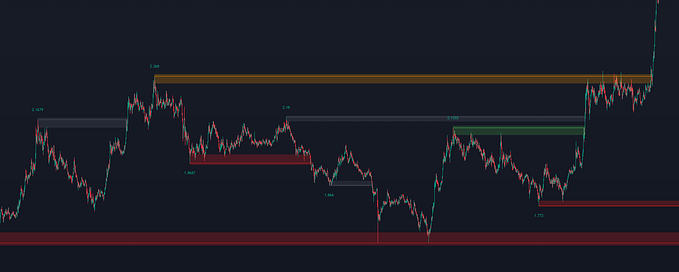

Taking funds from your bank account and investing them in cryptocurrencies, as well as depositing them into DeFi applications and then paying your rent from the potential profits you have made, is still an awful complex, time-consuming and expensive process.

Going in and out of crypto can take up to several days, leads to fees paid to multiple providers, involves more than one centralized counterparty and often triggers your personal bank asking you a lot of questions.

I am confident that all of the top industry players have recognised this, and that each of them is working on bringing the missing pieces together to attract the mass market and unleash the next growth phase in crypto adoption.

Each player approaches this problem from its angle, leveraging its strengths and expanding its product offering to achieve an end-to-end workflow.

The Contenders

Who do I think are these players and how are they approaching this problem?

Most of the above players share the dependence on FIAT on/off ramp providers so that users can utilise their idle funds in their bank account. On the other side, banks and FinTech providers that already have a payments infrastructure in place also struggle to compete.

Why FinTechs Struggle to Compete

Banks, “Neobanks”, and FinTechs that want to leverage the potential of crypto and want to offer their customers the ability to invest in digital assets are forced to integrate with exchanges and OTC desks.

But these integrations come with multiple downsides, hindering adoption and subsequently making these services costly and clunky for potential users:

- Costs: The fees that exchanges charge but also the basic connection costs are significant.

- Time: The door-to-door money movement between FinTechs and exchanges still takes a long time instead of seconds which are what crypto people are used to.

- Agility: Banks and FinTechs are slow movers compared to crypto-native companies. Complex processes already in place make adding offerings associated with digital assets becomes challenging.

For these reasons — all culminating in a high-cost structure, FinTech companies and banks are almost unable to offer free access to hop between traditional and crypto-assets.

FluidFi’s Unique Approach — Going From Your Bank Account to Crypto and Back in Seconds

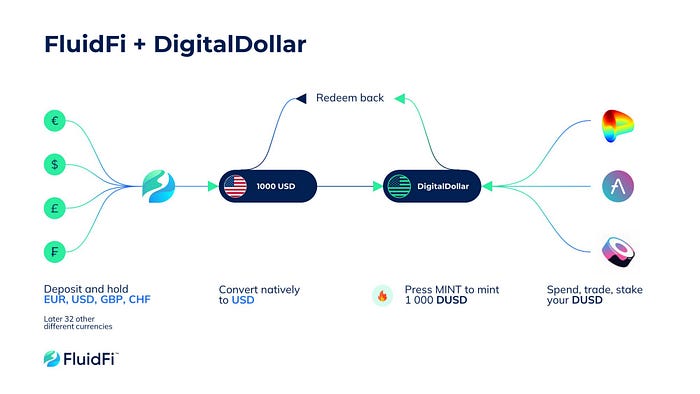

FluidFi’s approach is different, though, as they built their very own link between both worlds. Their infrastructure is following a best-of-breed strategy. Having integrated with Currencycloud — the same back-end partner used by Revolut and Klarna — allows them to offer their users all necessary banking features and full compatibility and compliance when it comes to receiving and sending FIAT funds globally.

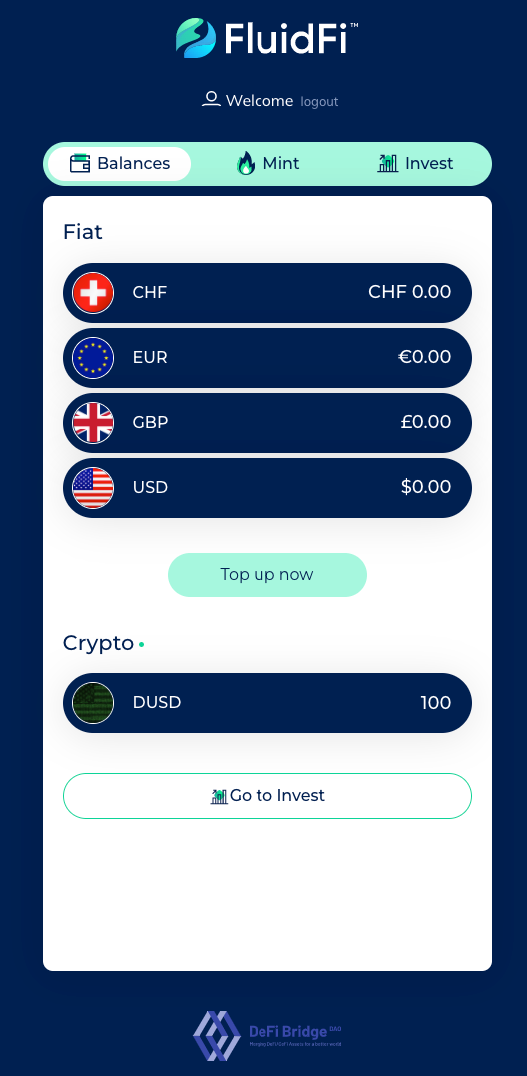

On the other side, FluidFi seems fully committed to transparency and leveraging the power of decentralised finance. Therefore, they built their own blockchain-based stablecoin (Digital Dollar, DUSD) and the minting and burning functionalities in-house. DUSD — which every FluidFi user can mint from his FIAT account balance — is already live on Arbitrum, a layer-2 scaling solution for Ethereum. (You can read up on DUSD on https://fluidfi.ch/fiatusd/).

What this allows users to do is not short of revolutionary because it has not been possible before: going from their bank account into crypto and bank in a matter of seconds.

Based on this setup, FluidFi is ideally suited to target two target groups: everyday users who want to put their idle funds to work and experienced DeFi “Degens” who want to zap in and out of the crypto ecosystem effortlessly.

The number of people who want to put their money to work despite rising inflation but are still overwhelmed dealing with crypto themselves is hard to overestimate. FluidFi allows them to earn a much higher yield than any bank offers them by utilising yield opportunities in DeFi. It just takes a few clicks for the users themselves, while FluidFi takes all the measures to protect and provide insurance for their customer’s positions. All of this is available from an almost free deposit account with full banking functionality.

For the experienced DeFi users, on the other side, the added value is to have a full-fledged bank account at their disposal from which they can move in and out of the crypto ecosystem by using a 100% backed and transparent stablecoin (DUSD). They can then access the endless investing and farming possibilities in the world of decentralised finance. It puts an end to when they got their bank accounts closed without further notice in fear of true innovation.

A Superior Offering for Customers Worldwide

FluidFi’s position is unique as they are not taking shortcuts with half-baked integrations but instead decided to go the entire way, offering comprehensive banking services and building the missing link to the crypto world ourselves. They can provide almost free accounts and unmatched speed and convenience when it comes to going in and out of crypto positions.

As a user of FluidFi, able to go from your bank account into crypto and back in seconds; why would you ever want to use an exchange again, where you need to wait for days for FIAT deposits and withdrawals to arrive, which still might be blocked by your bank as well as facing substantial costs in terms of fees for every trade you take?

If you have questions about FluidFi, their offering or want to engage with the community, head to their Telegram or Discord and join the conversation: